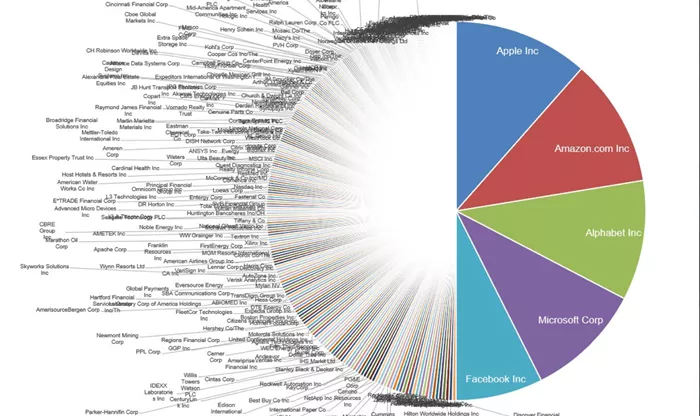

Investing in the stock market requires careful analysis and strategic decision-making. With market conditions continually evolving, identifying stocks with strong growth potential, solid fundamentals, and promising future prospects is essential. Here, we outline five stocks that currently stand out as excellent buys and worthy additions to any watchlist.

1. Apple Inc. (AAPL)

Why Invest in Apple

Apple Inc., a technology giant, continues to dominate the market with its innovative products and strong brand loyalty. The company’s diversified revenue streams, including hardware, software, and services, provide a stable financial base. Apple’s consistent revenue growth, robust balance sheet, and impressive cash flow generation make it a compelling investment.

Recent Performance and Future Prospects

Apple’s stock has shown resilience and growth, driven by strong sales of iPhones, Macs, and wearables. The company’s focus on expanding its services segment, including Apple Music, Apple TV+, and iCloud, offers significant growth potential. With ongoing advancements in augmented reality and potential ventures into electric vehicles, Apple remains a forward-thinking leader in technology.

2. Microsoft Corporation (MSFT)

Why Invest in Microsoft

Microsoft Corporation has established itself as a leader in software, cloud computing, and artificial intelligence. The company’s flagship products, such as Windows, Office, and Azure, have widespread adoption and generate substantial recurring revenue. Microsoft’s robust financial health, characterized by strong revenue growth and high profitability, enhances its investment appeal.

Recent Performance and Future Prospects

Microsoft’s cloud computing segment, Azure, continues to experience rapid growth, positioning the company as a key player in the digital transformation of businesses. The integration of AI technologies into its products, expansion of gaming with Xbox, and strategic acquisitions like LinkedIn and GitHub provide multiple avenues for future growth. Microsoft’s commitment to innovation and sustainability further strengthens its long-term prospects.

See also: Best Stocks To Buy Ahead Of Netflix Earnings

3. Amazon.com Inc. (AMZN)

Why Invest in Amazon

Amazon.com Inc. is a global leader in e-commerce, cloud computing, and digital streaming. The company’s diverse business model, encompassing online retail, Amazon Web Services (AWS), Prime memberships, and advertising, drives consistent revenue and profitability. Amazon’s dominant market position and relentless focus on customer experience make it a top pick for investors.

Recent Performance and Future Prospects

Amazon’s e-commerce segment continues to benefit from the shift towards online shopping, accelerated by the COVID-19 pandemic. AWS, the company’s cloud computing arm, remains a major growth driver, with expanding market share and increasing adoption of cloud services. Amazon’s ventures into healthcare, grocery, and entertainment, along with advancements in logistics and delivery, present additional growth opportunities.

4. Alphabet Inc. (GOOGL)

Why Invest in Alphabet

Alphabet Inc., the parent company of Google, is a dominant force in digital advertising, search, and cloud computing. The company’s strong revenue growth, driven by advertising and cloud services, underscores its financial stability. Alphabet’s commitment to innovation and diversification through investments in AI, autonomous vehicles, and other emerging technologies enhances its long-term value proposition.

Recent Performance and Future Prospects

Alphabet’s core advertising business continues to thrive, benefiting from the global shift towards digital marketing. Google Cloud is gaining traction, contributing significantly to revenue growth. Alphabet’s “Other Bets” segment, which includes ventures like Waymo (autonomous driving) and Verily (healthcare), showcases the company’s forward-thinking approach and potential for disruptive innovations.

See also: Here Are The Top 5 Stocks To Buy And Watch Right Now

5. Tesla Inc. (TSLA)

Why Invest in Tesla

Tesla Inc., a pioneer in electric vehicles (EVs), renewable energy, and battery storage, is at the forefront of the transition to sustainable energy. The company’s innovative products, strong brand recognition, and ambitious growth plans make it a standout investment. Tesla’s leadership in EV technology and its expanding product lineup drive its market appeal.

Recent Performance and Future Prospects

Tesla’s vehicle deliveries continue to grow, supported by increased production capacity and global demand for electric vehicles. The company’s advancements in battery technology, energy storage solutions, and solar products position it for long-term growth. Tesla’s vision for autonomous driving and its focus on expanding manufacturing capabilities globally enhance its growth potential.

Conclusion

Selecting the right stocks for your portfolio involves thorough research and consideration of various factors, including financial performance, market position, and future growth prospects. Apple, Microsoft, Amazon, Alphabet, and Tesla represent strong investment opportunities, each with unique strengths and promising outlooks. Adding these stocks to your watchlist or portfolio can provide exposure to leading companies poised for continued success in their respective industries. As always, it’s advisable to consult with a financial advisor and conduct your own research to align your investment choices with your financial goals and risk tolerance.

Related Topics: