Warren Buffett, the legendary investor and chairman of Berkshire Hathaway, is renowned for his investment acumen and ability to identify undervalued stocks with strong potential. One stock frequently associated with Buffett’s investment philosophy is Apple Inc. (AAPL). As it recently pulled back from its all-time highs, many investors are questioning whether this represents a buying opportunity. This article examines the reasons why Apple is considered an ultimate Warren Buffett stock and assesses whether it is a buy at its current levels.

Warren Buffett’s Investment Philosophy

Value Investing

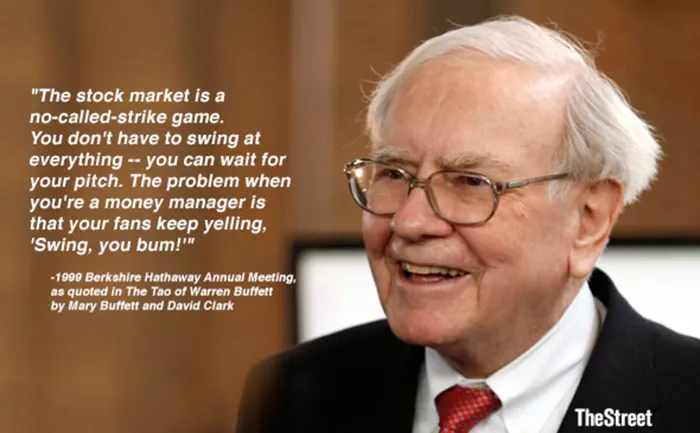

Warren Buffett’s investment strategy is rooted in value investing, which involves purchasing stocks that are undervalued relative to their intrinsic worth. Buffett looks for companies with strong fundamentals, sustainable competitive advantages, and consistent performance. His approach emphasizes long-term growth and stability over short-term gains.

Focus on Quality and Management

Buffett also prioritizes investing in companies with strong management teams and clear business models. He values businesses that are not only financially sound but also operate in industries with favorable long-term prospects. Buffett’s investments often reflect his confidence in the company’s leadership and its ability to generate value for shareholders.

Apple Inc. and Warren Buffett’s Investment

Apple’s Position in Buffett’s Portfolio

Apple Inc. is one of the largest holdings in Berkshire Hathaway’s investment portfolio. Buffett began acquiring Apple shares in 2016 and has since increased his stake, reflecting his belief in the company’s robust business model and growth potential. Apple’s strong financial performance, innovative products, and significant market presence align with Buffett’s investment criteria.

Financial Performance and Business Model

Strong Revenue and Profitability

Apple’s financial performance has been exceptional, with consistent revenue growth and high profitability. The company’s diversified product lineup, including the iPhone, iPad, Mac, and services, contributes to its strong financial results. Apple’s ability to generate substantial cash flow and maintain high profit margins aligns with Buffett’s preference for financially sound companies.

Innovative Ecosystem and Competitive Advantage

Apple’s ecosystem, which integrates hardware, software, and services, provides a competitive advantage and drives customer loyalty. The company’s innovation in technology and its ability to create a seamless user experience contribute to its strong market position. This competitive edge and brand strength are key factors that align with Buffett’s investment philosophy.

See also: Buffett’s Ultimate Stock At All-Time Highs: Buy Or Hold?

Assessing the Current Pullback

Market Conditions and Stock Valuation

Apple’s stock has recently experienced a pullback from its all-time highs, a common occurrence in the stock market. Various factors, such as broader market trends, economic conditions, and company-specific news, can contribute to stock price fluctuations. Analyzing Apple’s current valuation relative to its historical performance and future growth prospects is essential for assessing its attractiveness as an investment.

Opportunities and Risks

Potential Buying Opportunity

A pullback in Apple’s stock price may present a buying opportunity for investors who believe in the company’s long-term growth potential. If the stock is trading at a lower valuation compared to its intrinsic worth, it could be an attractive entry point. Investors should consider the company’s fundamentals, growth prospects, and overall market conditions when evaluating the potential for future gains.

Risks and Considerations

While Apple’s strong fundamentals make it a compelling investment, potential risks should be considered. Factors such as economic downturns, changes in consumer preferences, and competitive pressures could impact the company’s performance. It is important for investors to weigh these risks against the potential rewards and conduct thorough research before making investment decisions.

Conclusion

Apple Inc. exemplifies many of the qualities that Warren Buffett looks for in an investment, including a strong business model, competitive advantages, and financial stability. The recent pullback in Apple’s stock price may offer a buying opportunity for investors who are confident in the company’s long-term growth potential. As with any investment decision, it is crucial to assess the current market conditions, evaluate the company’s fundamentals, and consider potential risks.

For those adhering to Buffett’s investment principles, Apple remains a compelling stock due to its alignment with his value investing philosophy. Whether it is a buy at its current levels depends on individual investment goals, risk tolerance, and confidence in the company’s future performance.

Related Topics: