The potential value of Bitcoin in 2024 is a topic of great speculation among analysts, investors, and the broader crypto community. While predicting an exact price is difficult due to the volatility and unpredictability of the cryptocurrency market, several factors can provide insight into how high Bitcoin could go in 2024. Below, we’ll explore some of these factors, including market trends, macroeconomic conditions, technological developments, and historical patterns.

Historical Price Trends and Market Cycles

Bitcoin operates in a cyclical market, often following a pattern of boom and bust cycles. These cycles are closely linked to Bitcoin’s halving events, which occur approximately every four years. The most recent Bitcoin halving took place in May 2020, reducing the block reward from 12.5 to 6.25 BTC. Historically, the period following a halving has seen significant price appreciation due to reduced supply and increased demand.

Post-Halving Rally: Historically, Bitcoin tends to experience a major bull run in the 12 to 18 months following a halving. For instance, after the 2016 halving, Bitcoin surged from around $600 to nearly $20,000 by December 2017. Following the 2020 halving, Bitcoin reached new all-time highs of over $60,000 in 2021.

Potential 2024 Rally: With the next Bitcoin halving expected in 2024, many analysts predict a similar bull run, with the possibility of Bitcoin reaching new all-time highs. Some estimates suggest Bitcoin could reach $100,000 or higher during this cycle, though this depends on numerous factors.

Institutional Adoption and Interest

Institutional adoption of Bitcoin has been a key driver of its price growth in recent years. Major financial institutions, hedge funds, and even countries have started to view Bitcoin as a legitimate asset class.

Increased Investment: Companies like Tesla, MicroStrategy, and Square have made significant investments in Bitcoin. In addition, institutional investment products like Bitcoin ETFs (Exchange-Traded Funds) have opened the market to a broader range of investors.

Impact of ETFs and Funds: The approval of Bitcoin ETFs in several countries, including the U.S. and Canada, has allowed traditional investors to gain exposure to Bitcoin without directly holding the asset. This could drive additional demand in 2024, pushing prices higher as more institutional money flows into the market.

Global Macroeconomic Factors

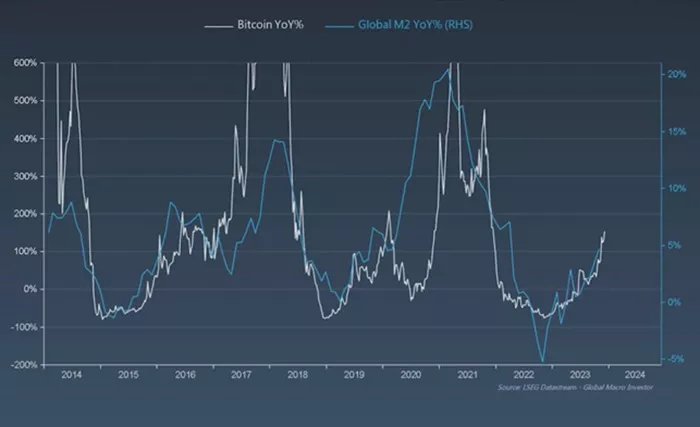

Global economic conditions, including inflation, interest rates, and monetary policy, also play a significant role in Bitcoin’s price movements.

Inflation Hedge: Bitcoin is often seen as “digital gold” and a hedge against inflation. In times of high inflation or monetary instability, investors may flock to Bitcoin as a store of value. If inflation continues to rise in 2024, demand for Bitcoin as a hedge could increase, driving its price upward.

Global Economic Instability: Geopolitical tensions, economic crises, and changes in government monetary policies can also affect Bitcoin’s price. If there is significant economic uncertainty in 2024, Bitcoin could be viewed as a safe-haven asset, similar to gold, which could lead to price appreciation.

See also: Will Bitcoin Rise Or Fall During The 2024 Olympics? Should I Buy It?

Technological Developments and Network Upgrades

Bitcoin’s underlying technology, as well as developments in the broader cryptocurrency ecosystem, can influence its price trajectory.

Lightning Network and Scaling Solutions: As Bitcoin faces challenges related to scalability, the development of second-layer solutions like the Lightning Network could help to improve transaction speed and reduce fees. This could make Bitcoin more attractive for everyday use, increasing demand.

Evolving Use Cases: Bitcoin is evolving beyond just a store of value. As more decentralized applications (dApps) and financial products are built on top of the Bitcoin network, the demand for Bitcoin as both a currency and a tool for decentralized finance (DeFi) could grow, leading to higher prices.

Regulatory Environment

Regulation is one of the biggest factors influencing Bitcoin’s future. In 2024, the regulatory environment for cryptocurrencies will continue to evolve, potentially impacting Bitcoin’s price in various ways.

Favorable Regulations: If governments create more favorable regulations for Bitcoin and other cryptocurrencies, this could foster greater adoption and drive the price higher. For example, clearer rules on Bitcoin ETFs, tax treatment, and cryptocurrency exchanges could attract more investors.

Negative Regulations: On the other hand, stricter regulations or bans on Bitcoin in certain countries could hinder its growth. Governments may impose heavy restrictions on trading, mining, or holding Bitcoin, which could suppress its price.

See also: Which Cryptocurrency Should I Invest In?

Bitcoin Mining and Energy Use

Bitcoin mining is another key factor that can influence the price of Bitcoin in 2024.

Mining Difficulty and Energy Costs: Bitcoin’s mining difficulty adjusts every two weeks based on the total computing power in the network. As more miners participate, the difficulty increases, requiring more energy and advanced hardware to mine new blocks. Rising energy costs could potentially reduce mining profitability, leading to a lower supply of newly minted Bitcoin.

Sustainable Mining: A growing focus on sustainability and renewable energy in Bitcoin mining could also affect Bitcoin’s perception and price. If the industry can pivot to more environmentally friendly practices, this could enhance Bitcoin’s appeal to ESG-conscious investors.

Price Predictions for 2024

Many experts have speculated on how high Bitcoin could go in 2024, though predictions vary widely. Some of the more optimistic estimates suggest that Bitcoin could reach anywhere from $100,000 to $250,000 by the end of 2024, while more conservative analysts believe it could stabilize between $50,000 and $100,000.

Optimistic Predictions: Bitcoin enthusiasts who are bullish on the cryptocurrency market often cite Bitcoin’s limited supply, increasing institutional adoption, and potential as a global reserve asset as reasons for believing that Bitcoin could reach $200,000 or more by 2024.

Conservative Predictions: More cautious analysts acknowledge the risks of market volatility, regulatory uncertainty, and potential competition from other cryptocurrencies. They predict that Bitcoin may reach a more modest range of $50,000 to $100,000.

Conclusion

The future price of Bitcoin in 2024 is influenced by a complex interplay of factors, including historical trends, institutional adoption, global economic conditions, technological developments, and regulatory policies. While it’s impossible to predict Bitcoin’s exact price, many signs point to the potential for significant growth, with optimistic estimates suggesting Bitcoin could reach new highs, potentially exceeding $100,000. However, market volatility, regulatory challenges, and external economic factors must also be considered, meaning that while Bitcoin’s ceiling in 2024 could be high, investors should remain cautious and aware of the risks.

Related Topics: