China’s recent policy initiatives are igniting a rally across various assets, including iron ore, copper, and Asian stocks. Traders are optimistic about further government support, fueling expectations for continued gains.

Emerging Market Gains

Following Tuesday’s announcements, emerging-market equities soared to their highest levels in over two years, while iron ore prices approached $100 per ton. The Thai baht rose to its highest point since March 2022, and Malaysia’s ringgit strengthened to levels not seen since mid-2021.

Cautious Optimism Amid Long-term Challenges

There is growing confidence that China’s markets may be on the verge of a sustainable recovery after years of decline driven by slow growth and a persistent property crisis. However, many market observers remain cautious, recalling that previous rallies have been short-lived as focus quickly reverted to underlying economic issues.

Anticipated Fiscal Stimulus

“We do think that there will be a follow-up to the stimulus,” said Shamaila Khan, head of emerging market and Asia Pacific fixed income at UBS Asset Management. She predicts that the next package will be fiscal in nature, which she believes will positively impact Asian currencies and commodities.

Immediate Market Reactions

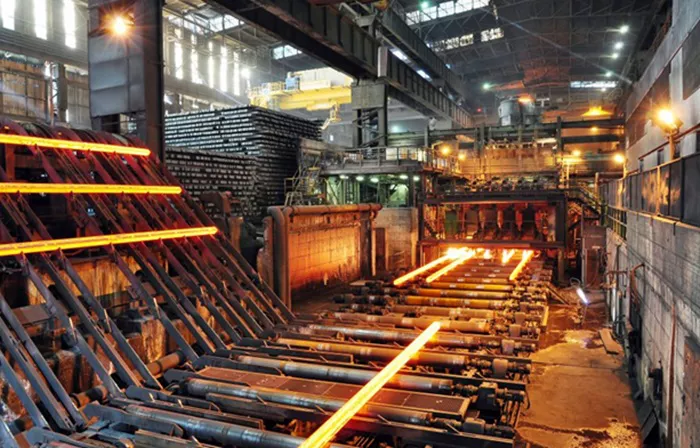

Beijing’s recent actions led to a flurry of buying in China-related assets, including the Australian dollar and various industrial metals. Asian shares benefitted significantly due to the region’s trade ties with China, with the MSCI Asia Pacific Index reaching its highest level since February 2022 on Wednesday.

Market Analysis and Expectations

“Fiscal follow-up will be the key,” wrote BNP Paribas SA economists, including Jacqueline Rong. They noted that the latest measures exceeded expectations and, combined with policies supporting the property and equity sectors, should enhance risk appetite, particularly given the low expectations in the market.

Strategic Insights from Experts

Jonathan Pines, head of Asia ex-Japan at Federated Hermes, described the stimulus package as a “multifaceted, strong” strategy, indicating the government’s serious commitment to addressing economic challenges. Jun Bei Liu of Tribeca Investment Partners noted that discussions with contacts in China revealed a strong sense of bullishness.

Upcoming Political Developments

The next few days may be critical in determining whether the current rally persists. Authorities may announce additional fiscal measures as President Xi Jinping’s 24-member Politburo prepares to meet ahead of a week-long holiday starting Tuesday. Potential announcements could include funding to purchase unsold homes and increased social welfare spending, as well as encouraging local governments to sell more bonds for infrastructure projects.

Caution Among Market Watchers

Despite the optimism, some analysts urge caution. They point to potential risks, including the upcoming U.S. presidential election and the possibility of further tariffs if Donald Trump wins. Escalating trade tensions could dampen demand for risk assets.

Lingering Economic Challenges

Timefolio Asset Management Co. and Magellan Investments Holding Ltd. highlight persistent issues, such as weak demand, ongoing property market struggles, and a deflationary spiral in China.

Conclusion

For now, the rally in risk assets may have room to grow. “This is a short-lived, legitimate risk-on signal to buy,” stated George Boubouras, head of research at K2 Asset Management. He emphasized the need for more substantial measures from China to sustain momentum. As market dynamics continue to evolve, investor sentiment remains critical in shaping future strategies.

Related Topics: