When referring to stocks, “Aon” typically refers to the ticker symbol for Aon plc, a global professional services firm. Understanding the context of this ticker symbol and what it signifies can provide insights into the company’s financial health and its position in the stock market. Below is a detailed exploration of what “Aon” means in the context of stocks.

Overview of Aon plc

Aon plc is a leading global professional services firm that specializes in risk, retirement, and health solutions. Headquartered in London, Aon operates across various sectors, providing advisory services and solutions to clients worldwide. The company is well-known for its expertise in insurance brokerage, risk management, and consulting services. As a publicly traded company, Aon plc’s stock is listed on major stock exchanges, including the New York Stock Exchange (NYSE), under the ticker symbol “AON.”

Ticker Symbol: AON

Definition and Purpose

In the stock market, a ticker symbol is a unique series of letters representing a particular publicly traded company. For Aon plc, “AON” is the ticker symbol used to identify its shares on the NYSE. Ticker symbols are crucial for investors as they simplify the trading and tracking of stocks. Each symbol serves as an identifier for a specific company, allowing for efficient buying, selling, and analysis of stock performance.

Historical Context

Aon’s ticker symbol “AON” has been used since the company’s initial public offering (IPO) or listing on the NYSE. The choice of ticker symbols is often influenced by various factors, including availability and relevance to the company’s brand. In Aon’s case, “AON” reflects the company’s name and brand identity, helping investors easily recognize and track its stock performance.

See also: What Does MoMo Mean In Stocks?

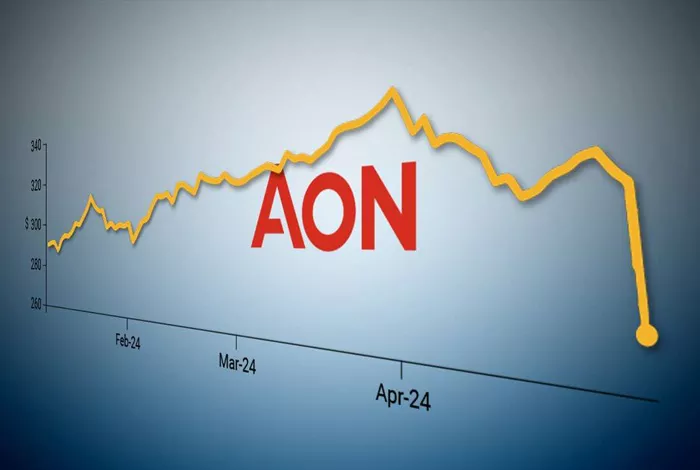

Aon plc’s Stock Performance

Stock Market Listing

Aon plc’s stock is primarily listed on the NYSE under the ticker symbol “AON.” This listing provides the company with access to a broad investor base and capital markets, facilitating trading and investment activities. The NYSE is one of the largest and most prestigious stock exchanges globally, known for listing leading companies from various industries.

Stock Performance and Metrics

Investors and analysts track Aon plc’s stock performance using various metrics, such as share price, market capitalization, earnings per share (EPS), and price-to-earnings (P/E) ratio. These metrics provide insights into the company’s financial health, profitability, and market valuation. Aon’s stock performance can be influenced by factors such as company earnings reports, industry trends, economic conditions, and overall market sentiment.

Dividends and Shareholder Returns

As a publicly traded company, Aon plc may distribute dividends to its shareholders. Dividends are typically paid from the company’s profits and provide a return on investment for stockholders. The dividend yield and payout ratio are important metrics for evaluating the attractiveness of Aon’s stock to income-focused investors. Shareholder returns are also affected by stock price appreciation or depreciation, reflecting the company’s performance and market conditions.

Factors Influencing Aon’s Stock

Company Performance

The financial performance of Aon plc, including revenue growth, profitability, and operational efficiency, significantly impacts its stock price. Positive financial results and successful business strategies can drive stock price increases, while challenges or underperformance may lead to declines.

Industry Trends

Aon’s stock performance can also be influenced by trends and developments in the professional services, insurance, and consulting industries. Changes in industry regulations, market demand, and competitive dynamics can affect Aon’s business operations and investor sentiment.

Economic and Market Conditions

Broader economic conditions and market trends play a role in shaping Aon’s stock performance. Economic factors such as interest rates, inflation, and economic growth can impact investor behavior and stock market performance. Additionally, overall market sentiment and macroeconomic events can affect Aon’s stock price.

See also: What Does IV Mean In Stocks?

Investment Considerations

Research and Analysis

Before investing in Aon plc or any other stock, it’s essential to conduct thorough research and analysis. This includes reviewing financial statements, understanding the company’s business model, assessing market conditions, and evaluating investment risks. Investors may use financial reports, analyst ratings, and market data to make informed decisions.

Diversification

Diversifying an investment portfolio helps manage risk and achieve balanced returns. While Aon plc may be a valuable addition to a portfolio, it is important to consider diversification strategies to mitigate potential losses and optimize overall investment performance.

Long-Term vs. Short-Term Investment

Investors should decide whether they are looking for long-term growth or short-term gains when investing in Aon plc. Long-term investors may focus on the company’s growth potential and fundamentals, while short-term traders may be more interested in market trends and short-term price movements.

Conclusion

In the context of stocks, “Aon” refers to the ticker symbol for Aon plc, a major global professional services firm listed on the NYSE. Understanding the significance of this ticker symbol, along with the factors influencing Aon’s stock performance, can provide valuable insights for investors. By analyzing the company’s financial metrics, industry trends, and market conditions, investors can make informed decisions about investing in Aon plc and assess its potential impact on their investment portfolio.

Related Topics: