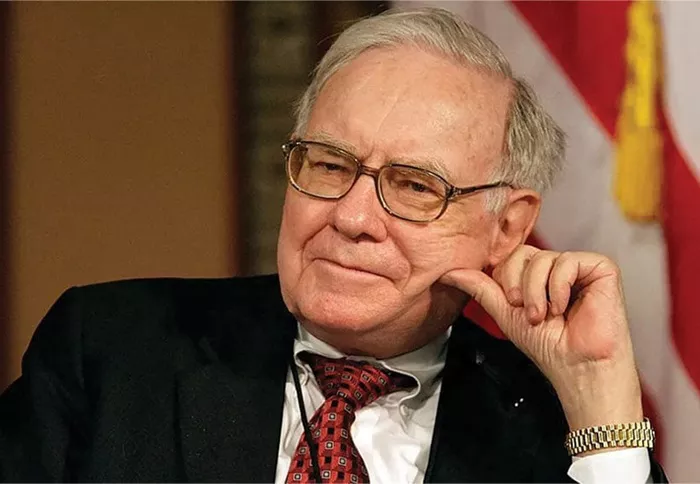

In a surprising move, legendary investor Warren Buffett incurred a substantial financial setback, with reports indicating that his sale of Apple stock cost him an estimated $6.2 billion. Known for his long-term investment strategies and steady hand during market fluctuations, Buffett’s decision to offload a portion of his stake in Apple has raised eyebrows across the financial world.

The Sale That Shook Markets

Buffett’s decision to sell Apple stock came amid market volatility, sparking speculation about his rationale. The timing of the sale proved costly, as Apple’s stock surged shortly after Buffett’s exit. Analysts estimate that the sale cost Buffett and his firm, Berkshire Hathaway, a staggering $6.2 billion in potential profits. The sale, seen as a departure from Buffett’s typical buy-and-hold strategy, marked one of the more significant missteps in his storied investing career.

Buffett’s Relationship With Apple

Warren Buffett has long been a champion of Apple, with his investment in the tech giant considered one of the crown jewels in Berkshire Hathaway’s portfolio. Apple has consistently been one of Berkshire’s largest holdings, generating significant returns for the firm over the years. The recent sale, therefore, came as a surprise to many who follow Buffett’s investment philosophy of maintaining stakes in strong, long-term assets.

Market Repercussions

Buffett’s decision to sell a portion of Apple stock sent ripples through the financial markets, with some investors questioning whether his move signaled concerns about Apple’s future prospects. However, Apple’s performance continued to strengthen, with its stock price rebounding quickly after the sale, amplifying the losses Buffett incurred by selling early. The incident highlights the unpredictable nature of the stock market and the challenges even the most experienced investors face.

Lessons for Investors

Warren Buffett’s costly sale of Apple stock serves as a reminder of the risks associated with market timing, even for seasoned investors. His experience underscores the importance of maintaining a long-term perspective, particularly with high-quality stocks like Apple. While Buffett’s overall investing record remains stellar, this episode demonstrates that no investor is immune to the pitfalls of market uncertainty.

Conclusion

Warren Buffett’s decision to sell a significant portion of Apple stock ultimately cost him and Berkshire Hathaway $6.2 billion, marking a rare misstep in his otherwise remarkable investment career. The move has sparked discussion about the challenges of navigating volatile markets, even for the most accomplished investors. As Apple continues to thrive, Buffett’s sale stands as a notable example of the complexities and unpredictability inherent in the stock market.

Related Topics: