Smith & Wesson (NASDAQ: SWBI), a storied American firearms manufacturer, has reported disappointing results for the second quarter of the calendar year 2024. With a significant revenue decline and a shift from profit to loss, investors are left questioning whether this is an opportune moment to buy into the stock. This report delves into the financial highlights, operational metrics, and future outlook to provide a comprehensive view of Smith & Wesson’s current standing.

Q2 CY2024 Financial Highlights

Revenue and Earnings

Revenue: $88.33 million, down 22.7% year-over-year. This figure falls short of analyst expectations, which were set at $102.5 million, representing a 13.8% miss.

Earnings Per Share (EPS): -$0.05, missing the anticipated -$0.02 by $0.03. This marks a shift from a profit of $0.07 per share in the same quarter last year.

Profit Margins

Gross Margin: 27.4%, consistent with the previous year’s figures, indicating stability in cost management relative to sales.

EBITDA Margin: 11.2%, reflecting the company’s operational earnings before interest, taxes, depreciation, and amortization.

Free Cash Flow Margin: -40.2%, signaling significant negative cash flow from operations.

Market Capitalization

Market Cap: $642.4 million, indicating the overall market value of the company’s outstanding shares.

Management Commentary

Mark Smith, President and CEO of Smith & Wesson, acknowledged the softer-than-expected demand during the first fiscal quarter but emphasized the company’s adaptable manufacturing model. Smith highlighted the anticipated rebound in demand as the company enters the busy fall season and expressed optimism about the new Bodyguard 2.0 conceal carry pistol’s performance. He believes that upcoming product innovations and increased production capacity will counteract current challenges and drive growth for the remainder of the fiscal year.

Historical Performance and Sales Growth

Smith & Wesson’s revenue has experienced a decline of 3% per year over the past five years, reflecting a broader trend of weak demand. More recently, the company’s revenue has decreased by 13% annually over the last two years. This ongoing trend indicates a challenging market environment and raises questions about the company’s ability to regain and sustain growth.

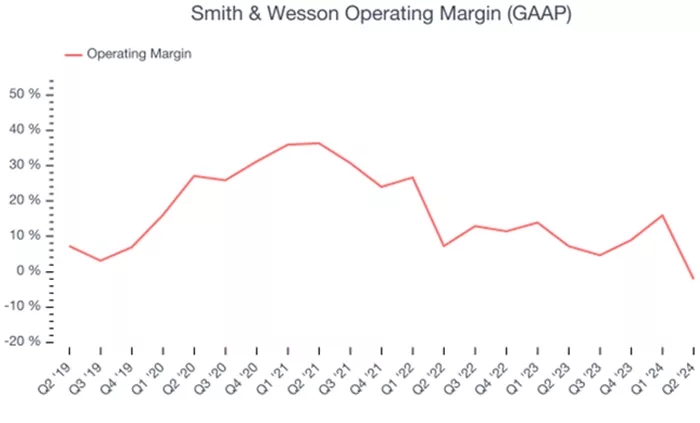

Operating Margin Analysis

The operating margin has been in decline, averaging 9.9% over the past year. This quarter, the company reported a negative operating profit margin of -2.1%, a significant decrease of 9.3 percentage points from the previous year. This decline suggests increased operational inefficiencies and higher relative expenses.

Key Takeaways

Smith & Wesson’s recent earnings report revealed a substantial revenue decline, falling significantly short of expectations, which triggered an immediate 8.5% drop in its stock price. This shortfall highlights serious profitability concerns, as the company has transitioned from profit to a loss while experiencing negative free cash flow. These factors raise questions about the company’s financial health and operational efficiency. However, amidst these challenges, there is a glimmer of hope for future recovery and growth. Management’s emphasis on product innovation and market adaptation could provide a path forward, potentially positioning the company for a turnaround despite the current difficulties.

Conclusion

Smith & Wesson’s Q2 CY2024 results reveal a challenging quarter with notable declines in revenue and profitability. While the company’s historical performance and current operational metrics paint a cautious picture, there are elements of potential recovery, such as new product launches and anticipated demand rebound. Investors considering Smith & Wesson should weigh these factors carefully against the backdrop of the company’s recent performance and broader market conditions.

Related Topics: