When analyzing stocks and making investment decisions, one of the key metrics investors use is “beta.” Beta is a measure of a stock’s volatility or risk relative to the overall market. Understanding beta can help investors gauge how much a stock might move in relation to market movements, aiding in portfolio management and risk assessment. This detailed guide explores what beta is in stocks, how it is calculated, and its significance in stock investing.

What Is Beta

1. Definition of Beta

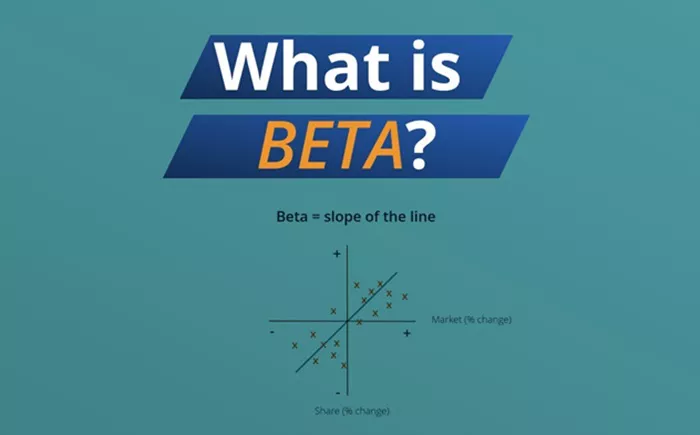

Beta is a statistical measure used in finance to quantify a stock’s relative volatility compared to the market as a whole. Specifically, beta measures how much a stock’s price tends to move in relation to movements in a market index, such as the S&P 500. The market index is typically assigned a beta of 1.0, and individual stocks are compared to this baseline.

2. Interpreting Beta Values

Beta > 1.0: A stock with a beta greater than 1.0 is considered more volatile than the market. For example, a beta of 1.5 suggests that the stock is expected to move 50% more than the market index. If the market goes up by 1%, the stock is likely to rise by 1.5%, and if the market falls by 1%, the stock is expected to drop by 1.5%.

Beta = 1.0: A beta of 1.0 indicates that the stock’s price movements are expected to closely follow those of the market index. It implies that the stock’s volatility is in line with the market.

Beta < 1.0: A stock with a beta less than 1.0 is considered less volatile than the market. For instance, a beta of 0.7 suggests that the stock is expected to move 30% less than the market. If the market rises by 1%, the stock might only increase by 0.7%, and if the market falls by 1%, the stock could drop by 0.7%.

Beta < 0: A negative beta indicates an inverse relationship with the market. This is relatively rare but means that the stock tends to move in the opposite direction of the market. For instance, a beta of -1.0 would imply that if the market goes up by 1%, the stock would decrease by 1%, and vice versa.

How Beta Is Calculated

1. Data Required for Calculation

To calculate beta, you need historical price data for the stock and the market index. Typically, this involves:

Stock Prices: Historical closing prices of the individual stock.

Market Index Prices: Historical closing prices of the market index, such as the S&P 500.

Time Period: A specified time period over which the stock and market index prices are analyzed (e.g., one year, five years).

2. Statistical Formula

The beta calculation involves regression analysis. The formula used is:

- Beta= Covariance(Stock Returns,Market Returns) / Variance(Market Returns)

Here’s a simplified breakdown of the components:

Covariance: Measures how the stock’s returns move in relation to the market’s returns.

Variance: Measures the variability of the market’s returns.

By analyzing the covariance between the stock’s returns and the market’s returns, and then dividing by the variance of the market’s returns, beta provides a measure of the stock’s relative volatility.

See also: What Is a P/E Ratio in Stocks?

Significance of Beta

1. Risk Assessment

Beta is a crucial tool for assessing a stock’s risk relative to the market. A higher beta indicates greater risk, which may appeal to investors seeking higher potential returns but who are willing to accept more volatility. Conversely, a lower beta suggests lower risk and may appeal to conservative investors looking for stability.

2. Portfolio Management

Investors use beta to manage their portfolios and balance risk. By combining stocks with different betas, investors can tailor the overall risk profile of their portfolio. For example, adding low-beta stocks to a portfolio with high-beta stocks can help reduce the overall volatility.

3. Investment Strategy

Aggressive Investors: Those seeking higher returns might favor stocks with a beta greater than 1.0, as these stocks have the potential for greater gains (and losses) compared to the market.

Conservative Investors: Investors who prioritize stability might opt for stocks with a beta less than 1.0, aiming for a more predictable performance relative to market fluctuations.

4. Performance Evaluation

Beta can also be used to evaluate the performance of a stock relative to its expected volatility. If a stock with a high beta performs better than expected, it may indicate stronger-than-anticipated performance relative to its risk level. Conversely, if a low-beta stock underperforms, it may suggest weaknesses in its stability or growth prospects.

See also: What Does 52 Week Range Mean in Stocks?

Limitations of Beta

1. Historical Data Dependence

Beta is calculated using historical data, which may not always predict future performance accurately. Changes in market conditions, company fundamentals, or economic factors can affect a stock’s future volatility, making historical beta less reliable.

2. Market Index Selection

The choice of market index for beta calculation can influence the result. Different indices may have different characteristics and volatility, which can affect the beta value.

3. Not a Comprehensive Risk Measure

While beta measures market-related risk, it does not capture all aspects of a stock’s risk profile, such as company-specific risks or systemic risks not related to market movements.

Conclusion

Beta is a valuable metric for understanding a stock’s volatility and its potential impact on your investment portfolio. By comparing a stock’s beta to the market index, investors can gauge the stock’s risk relative to broader market movements. However, it’s important to use beta in conjunction with other financial metrics and qualitative factors to make informed investment decisions. Understanding the limitations and proper application of beta can help investors better manage risk and align their investment strategies with their financial goals.

Related Topics: