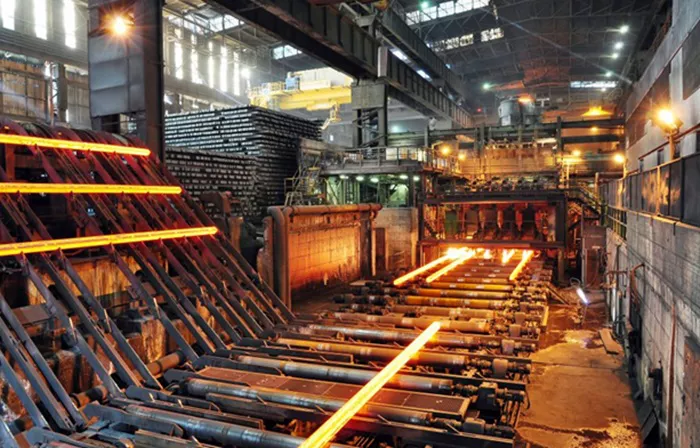

China’s steel production experienced a significant downturn in August, with output dropping more than 10% compared to the same month last year. The world’s largest steel sector is struggling with persistently low prices and a sharp decline in demand.

Production Figures and Industry Challenges

According to data from the National Bureau of Statistics, crude steel production fell by 10.4% year-on-year to 77.9 million tons in August. This represents the weakest August performance since 2017 and contributes to a broader decline observed throughout the year. For the first eight months of 2024, total steel production was down 3.3%, totaling 691.4 million tons.

Factors Behind the Decline

China’s steel demand, which had been growing for over two decades due to rapid industrialization and urbanization, is now contracting. This year, and particularly this summer, the downturn in construction activity has exacerbated the situation. Major steel suppliers like China Baowu Steel Group Corp. have reported worsening conditions, prompting many mills to shut down furnaces due to deepening losses on their products.

Signs of Recovery

Despite the current challenges, there are some tentative signs of recovery. In September, steel prices have shown modest increases, and iron ore futures have rebounded from a slump below $90 per ton, marking a weekly gain.

Broader Economic Impacts

China’s broader economic difficulties, including a struggling property market and weak consumer confidence, are also impacting other sectors such as oil. Recent data highlights a decrease in crude throughput, a key indicator of productivity in the world’s largest oil refining market, which fell by 6.2% year-on-year to 59.07 million tons in August.

Conclusion

China’s steel industry is facing substantial headwinds as it deals with low prices and diminishing demand. While there are some signs of potential improvement, the broader economic context, including weak oil demand, underscores the ongoing challenges for China’s industrial sectors.

Related Topics:.