Investing in stocks can be complex, and choosing the right stock is often the key to successful investing. To make well-informed decisions, investors rely on a variety of tools and metrics to evaluate whether a stock is fairly priced. One such popular metric is the Price-to-Earnings Growth (PEG) ratio. The PEG ratio helps investors assess a stock’s value while taking its expected growth into account, making it a powerful tool in identifying whether a stock is under or overvalued. In this article, we will explore what the PEG ratio is in stocks, how it works, and what constitutes a good PEG ratio for stocks. We will also look into the limitations of this metric and how investors can effectively use it in their investment strategies.

Introduction to Stock Valuation Metrics

When evaluating stocks, many investors turn to common valuation metrics such as the Price-to-Earnings (P/E) ratio. The P/E ratio compares a company’s stock price to its earnings per share (EPS). While the P/E ratio is a useful tool, it does not consider a company’s future growth prospects. This is where the PEG ratio comes in.

The PEG ratio is an extension of the P/E ratio that factors in a company’s expected earnings growth. It provides a more comprehensive view of the stock’s valuation by accounting for the potential increase in earnings over time. In simple terms, while the P/E ratio tells you how expensive a stock is relative to its earnings, the PEG ratio helps you understand whether that price is justified based on how much the company is expected to grow.

Why Growth Matters

Growth is a critical factor in stock investing. Companies that are expected to grow their earnings at a high rate are often more valuable because they may generate greater returns for investors over time. However, paying too much for growth can be risky. The PEG ratio helps strike a balance between paying a reasonable price and investing in companies with strong growth potential.

Now that we understand why the PEG ratio is important, let’s explore its meaning, how to calculate it, and what constitutes a good PEG ratio.

Understanding the PEG Ratio

What is the PEG Ratio

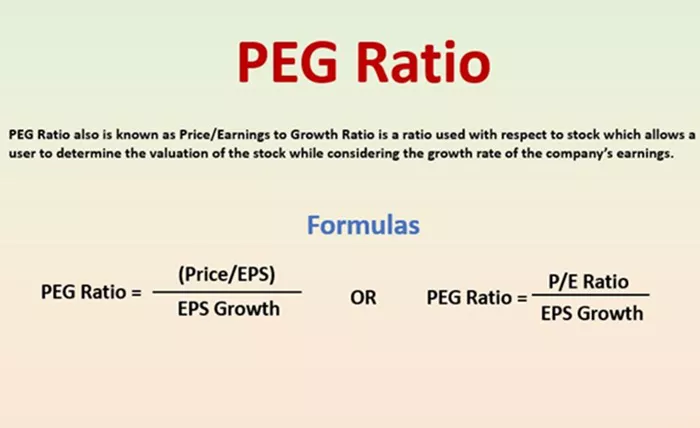

The PEG ratio stands for Price-to-Earnings Growth ratio. It is a metric that helps investors determine whether a stock is overvalued, undervalued, or fairly priced by incorporating expected earnings growth into the equation. The PEG ratio takes the P/E ratio one step further by dividing it by the company’s expected earnings growth rate.

PEG Ratio Formula:

- PEG Ratio= P/E Ratio / Earnings Growth Rate

Where:

- P/E Ratio is the Price-to-Earnings ratio of the stock.

Earnings Growth Rate is the company’s projected annual earnings growth rate, usually expressed as a percentage.

The PEG ratio helps investors avoid overpaying for stocks that may appear attractive based solely on their P/E ratio. For example, a stock with a low P/E ratio might seem like a good deal, but if it has poor growth prospects, it may not be a sound investment. Conversely, a stock with a high P/E ratio might be justified if it is expected to experience significant earnings growth in the future.

See also: What Is Moat in Stocks?

Interpreting the PEG Ratio

To interpret the PEG ratio, it is important to understand the following general guidelines:

PEG = 1: A PEG ratio of 1 suggests that the stock is fairly valued based on its expected earnings growth. In this case, the stock’s price is in line with its future earnings potential.

PEG < 1: A PEG ratio of less than 1 indicates that the stock may be undervalued. The stock’s price is lower relative to its earnings growth, making it potentially a good value.

PEG > 1: A PEG ratio greater than 1 implies that the stock may be overvalued. The stock price is higher compared to the earnings growth expected, which might suggest that investors are paying a premium for the stock.

Example of PEG Ratio Calculation

Let’s take a practical example to better understand how to calculate and interpret the PEG ratio.

Suppose you are evaluating a technology stock with the following details:

Current stock price: $100

Earnings per share (EPS): $5

Projected annual earnings growth rate: 20%

First, calculate the P/E ratio:

- P/E Ratio= Stock Price / EPS=100/50=20

Now, calculate the PEG ratio by dividing the P/E ratio by the expected earnings growth rate:

- PEG Ratio= P/E Ratio / Growth Rate=20/20=1

In this case, the stock has a PEG ratio of 1, suggesting it is fairly valued based on its growth prospects.

What Is a Good PEG Ratio

A good PEG ratio can vary depending on the industry, the economic environment, and the specific stock in question. However, there are some general benchmarks that investors can use to gauge the value of a stock based on its PEG ratio.

PEG Ratio Less Than 1

A PEG ratio of less than 1 is often considered ideal by many value investors. This suggests that the stock is potentially undervalued because its price is low relative to its expected growth. For example, if a stock has a P/E ratio of 10 and a projected growth rate of 20%, the PEG ratio would be 0.5. This might indicate a good buying opportunity since you are paying a lower price for strong future growth.

PEG Ratio Equal to 1

A PEG ratio of 1 indicates that the stock’s price is in line with its earnings growth rate. In this case, the stock is considered fairly valued, meaning investors are paying a reasonable price for the expected earnings growth. This balance between price and growth makes a PEG of 1 a solid benchmark for many investors.

PEG Ratio Greater Than 1

A PEG ratio greater than 1 suggests that the stock may be overvalued relative to its earnings growth. Investors are paying a higher price for the stock compared to the future growth expected. For example, if a stock has a P/E ratio of 25 and a growth rate of 10%, the PEG ratio would be 2.5, which might be a red flag indicating that the stock is too expensive.

However, there are exceptions. Stocks in certain industries, such as technology or healthcare, may consistently have higher PEG ratios because they are expected to grow rapidly. In such cases, a PEG ratio above 1 may not necessarily indicate overvaluation, especially if the company’s growth potential is strong and sustainable.

See also: What Does High Volume Mean in Stocks?

Factors to Consider When Evaluating the PEG Ratio

While the PEG ratio is a useful tool for stock evaluation, it should not be used in isolation. There are several factors that investors should consider when determining what constitutes a good PEG ratio.

Industry Averages

Different industries have different growth rates, so what may be considered a good PEG ratio for one sector may not apply to another. For example, technology companies often have higher growth rates than utility companies, which tend to grow slowly but steadily. It is important to compare a company’s PEG ratio to the industry average rather than using a single universal benchmark.

Growth Projections

The accuracy of the PEG ratio depends heavily on the accuracy of earnings growth projections. Growth rates are typically based on analysts’ estimates, which can sometimes be overly optimistic or conservative. Investors should be aware that unexpected market conditions, competition, or changes in the company’s business environment can affect actual growth rates.

Market Conditions

Overall market conditions can also impact what is considered a good PEG ratio. During bull markets, stocks may be priced higher because of investor optimism, leading to higher PEG ratios across the board. Conversely, in bear markets, PEG ratios might be lower due to reduced stock prices and tempered growth expectations.

Quality of Earnings

Not all earnings are created equal. Investors should assess the quality of a company’s earnings growth. Sustainable, consistent growth from a company’s core operations is more valuable than one-time gains or growth from volatile segments. If a company’s earnings growth is driven by non-recurring factors, such as asset sales or accounting adjustments, its PEG ratio may not be as reliable.

Long-Term vs. Short-Term Growth

The PEG ratio typically focuses on short-term growth projections, usually over the next year or two. However, long-term growth potential is also critical. A company with a PEG ratio of 1 might seem fairly valued for the next year, but if its long-term growth prospects are weak, it may not be a good investment over the long haul.

Limitations of the PEG Ratio

While the PEG ratio is a valuable tool, it has its limitations. Investors should be aware of these potential drawbacks to avoid relying too heavily on this metric.

Reliance on Forecasts

The PEG ratio depends on earnings growth forecasts, which are inherently uncertain. Analysts’ projections may not always be accurate, leading to misleading PEG ratios. Overly optimistic or pessimistic growth estimates can skew the ratio, giving investors a false sense of a stock’s value.

Focus on Earnings Growth Only

The PEG ratio focuses exclusively on earnings growth and does not account for other important factors such as dividends, debt levels, or cash flow. A company with strong earnings growth but poor financial health may have a low PEG ratio but still be a risky investment.

Short-Term Perspective

The PEG ratio often reflects short-term growth expectations, which may not capture a company’s long-term potential. Stocks with high short-term growth but uncertain long-term prospects can have misleading PEG ratios.

Not Suitable for All Companies

The PEG ratio is not always suitable for all types of companies. For example, mature companies with slow growth may have high PEG ratios but still be solid investments because of their stability and strong dividend yields. Similarly, start-ups or companies in emerging industries may have negative earnings, making the PEG ratio difficult to calculate.

Conclusion

The PEG ratio is a powerful tool that allows investors to evaluate the value of a stock while considering its growth potential. A PEG ratio of less than 1 often signals an undervalued stock, while a PEG ratio of more than 1 may indicate overvaluation. However, the PEG ratio should not be used in isolation. Investors need to consider industry averages, growth projections, and market conditions, among other factors, to make a well-rounded investment decision. Ultimately, while the PEG ratio can guide investors toward better investment decisions, it is essential to use it alongside other valuation metrics to get a clearer picture of a stock’s true potential. Understanding the limitations of the PEG ratio will help investors avoid common pitfalls and make smarter, more informed decisions in the stock market.

Related Topics: