The United States is one of the largest oil consumers in the world, and its demand for crude oil is met through both domestic production and imports. While the U.S. has made significant strides in increasing its own oil production, particularly in recent years, the country still relies heavily on imports to meet its needs. This dependency is shaped by a range of factors, including the global distribution of oil reserves, refining capacities, and the intricacies of international trade agreements. In this article, we will explore the primary countries from which the U.S. imports crude oil, the role these imports play in the nation’s energy security, and the economic and political implications of such trade.

The Importance of Crude Oil Imports

The U.S. imports crude oil for several reasons, despite being one of the world’s leading oil producers. One key reason is that different types of crude oil are needed for different types of refineries. Some refineries are specifically designed to process heavier crude oils, which are not always readily available from domestic sources. Additionally, oil importation allows the U.S. to diversify its supply sources, helping to ensure a stable and secure energy supply. Global trade dynamics and geopolitical relations also play an important role in shaping the flow of crude oil imports to the U.S.

The Top Oil Importing Countries to the U.S.

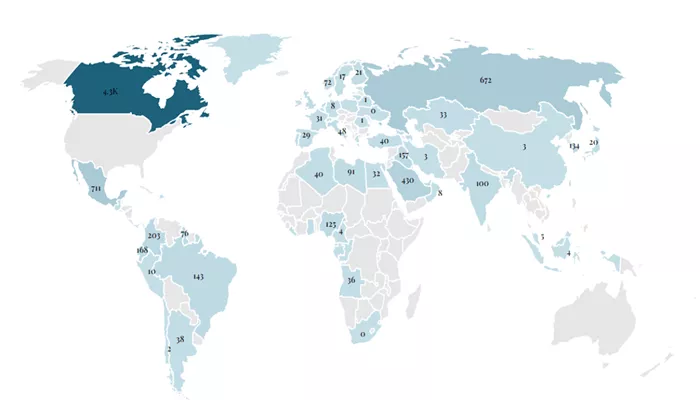

The United States imports crude oil from a variety of countries, with the largest suppliers being Canada, Mexico, and several nations in the Middle East. However, the bulk of U.S. imports come from neighboring Canada, which has been the U.S.’s top supplier of crude oil for many years. Let’s take a closer look at the main countries from which the U.S. imports crude oil.

Canada: The Largest Supplier

Canada is the largest exporter of crude oil to the United States, accounting for nearly 60% of the total U.S. crude oil imports. The proximity of Canada to the U.S. is a significant factor in this relationship. The two countries share an extensive pipeline network that facilitates the easy and reliable transport of oil. Canada’s oil sands in Alberta have become a major source of heavy crude oil, which is in demand in U.S. refineries. This has made Canada an essential partner in the U.S.’s efforts to secure a stable and continuous supply of crude oil.

The U.S. and Canada have a well-established trade relationship, and this has been reflected in their oil dealings. Canada’s oil industry is also seen as a stable and reliable source, as it is less likely to be affected by political instability compared to other oil-producing regions. Additionally, the environmental regulations in Canada’s oil production sector are more stringent than in many other oil-exporting countries, which aligns well with the U.S. commitment to sustainability.

Mexico: A Close Neighbor and Key Supplier

Mexico is another key supplier of crude oil to the United States. While the amount of crude oil Mexico exports to the U.S. is significantly lower than that of Canada, it still plays a crucial role in the overall energy landscape. Mexico’s oil production has faced challenges in recent years, but it remains a significant source of light crude oil, which is processed in U.S. refineries.

Mexico and the U.S. have long-standing economic and trade ties, which make crude oil trade between the two countries particularly important. In addition to crude oil, the U.S. exports refined products to Mexico, creating a mutually beneficial trade relationship. However, Mexico’s production has been on the decline, and this has raised concerns about the long-term sustainability of the oil trade between the two nations.

Saudi Arabia: A Historic Supplier

Saudi Arabia, the world’s largest oil exporter, has traditionally been one of the United States’ most important crude oil suppliers. However, in recent years, the U.S. has reduced its reliance on Saudi oil as domestic production has risen. Despite this decline, Saudi Arabia still plays a key role in U.S. oil imports. Saudi Arabia produces a significant amount of light crude oil, which is in demand by U.S. refineries.

The U.S. relationship with Saudi Arabia is also influenced by political and economic factors. The Kingdom’s role in the Organization of the Petroleum Exporting Countries (OPEC) has been a critical factor in global oil supply management. While the U.S. imports less oil from Saudi Arabia now than in the past, the country remains an influential player in global oil markets.

Other Key Suppliers: Venezuela and Iraq

In addition to the major suppliers mentioned above, the United States imports crude oil from a variety of other countries, including Venezuela and Iraq. Venezuela, which has some of the largest oil reserves in the world, has historically been a significant supplier to the U.S. However, political instability and economic sanctions have severely disrupted this trade in recent years.

Iraq, another member of OPEC, has become an increasingly important supplier of crude oil to the U.S. in recent years. The country produces a variety of crude oil grades that are suitable for U.S. refineries. Despite the challenges posed by instability in the region, Iraq has managed to maintain its position as a significant player in the global oil market.

The Impact of Global Events on Oil Imports

The flow of crude oil imports to the U.S. is influenced by a range of global events and geopolitical dynamics. Natural disasters, political instability, wars, and economic sanctions can all disrupt the flow of oil and lead to price fluctuations. For example, tensions in the Middle East often have a direct impact on oil prices, as the region is home to many of the world’s largest oil reserves.

Changes in global supply and demand can also shift trade patterns. For instance, the rise of shale oil production in the U.S. has reduced the country’s dependence on foreign oil, but it has not eliminated the need for imports altogether. While U.S. production has increased, certain types of crude oil remain in demand that is not easily sourced domestically.

The U.S. Role in the Global Oil Market

The U.S. plays a significant role in the global oil market, both as a major consumer and a producer. Its increasing domestic production, particularly from shale oil reserves, has altered the global supply and demand dynamics. However, the country continues to be a major importer of crude oil, particularly from Canada and other suppliers in the Western Hemisphere.

U.S. oil policies, including those related to environmental regulations and energy independence, will continue to influence the country’s oil import patterns. The ongoing debate over the U.S.’s role in the global energy market reflects the complexities of balancing domestic production, environmental concerns, and international trade.

Conclusion

The United States imports crude oil from a variety of countries, with Canada being by far the largest supplier. Mexico, Saudi Arabia, Venezuela, and Iraq also play significant roles in meeting the country’s oil needs. These imports are driven by a combination of factors, including the demand for different types of crude oil, political relationships, and the intricacies of the global oil market. While the U.S. has made significant strides in increasing its domestic production, oil imports remain an essential component of its energy strategy. Understanding the countries from which the U.S. imports crude oil provides valuable insight into the nation’s energy landscape and its relationship with the global oil market.

Related Topics:

Canada’s Oil Industry Poised to Surpass U.S. Shale Amid Falling Prices

US Steps Up Pressure on Iran’s Oil Trade with New Sanctions

Indonesia Awards Five Oil and Gas Blocks to Strengthen Reserves