For anyone in the United Kingdom looking to grow their wealth over time, the Stocks and Shares ISA is one of the most powerful tools available. It combines the potential of investing in markets with the significant tax advantages that come with the ISA (Individual Savings Account) structure. Whether you’re a first-time investor or someone looking to diversify an existing portfolio, understanding how a Stocks and Shares ISA operates is essential to making informed financial decisions.

At its core, a Stocks and Shares ISA is a tax-efficient investment account. It allows individuals to invest in a range of assets—including company shares, bonds, mutual funds, and exchange-traded funds (ETFs)—without paying tax on capital gains or income earned from dividends. Each year, the UK government sets a contribution limit for ISAs. For the 2024/2025 tax year, that limit stands at £20,000. You can invest the entire amount in a Stocks and Shares ISA or divide it among different ISA types, such as a Cash ISA or an Innovative Finance ISA.

What Makes Stocks and Shares ISAs So Attractive?

The main appeal of a Stocks and Shares ISA lies in its tax advantages. Any gains you make from your investments within this account are completely free from Capital Gains Tax. Similarly, dividends and interest payments earned on investments are not subject to Income Tax. Over time, especially for long-term investors, this tax shelter can lead to significantly higher returns compared to a standard investment account.

In addition to the tax relief, these ISAs offer flexibility. You can choose from a wide range of investment types and strategies. Whether you’re interested in blue-chip shares, high-growth tech stocks, or globally diversified index funds, a Stocks and Shares ISA gives you access. You can manage the account yourself through an online brokerage or let a professional manage it for you through a robo-adviser or wealth management firm.

Another advantage is the simplicity of the ISA system. You don’t need to declare ISA investments on your tax return, which reduces paperwork and administrative hassle. Plus, once money is inside the ISA, you can switch between investments freely without triggering tax events.

Who Can Open a Stocks and Shares ISA?

To open a Stocks and Shares ISA, you must be a UK resident aged 18 or older. Non-residents are not eligible, even if they have previously held an ISA while living in the UK. You can only open and contribute to one Stocks and Shares ISA per tax year, though you can hold multiple ISAs from previous years with different providers if you wish.

Providers range from traditional banks and investment firms to newer digital platforms. Each provider offers a different selection of investment products, fee structures, and user experiences. Before choosing a provider, it’s important to compare these factors and decide whether you want to manage your investments actively or passively.

Once opened, your ISA contributions must come from money that has already been taxed—meaning you fund the ISA with income from your salary or savings. There is no upfront tax deduction like with a pension, but the growth within the ISA is sheltered from tax.

How Does Investing Within an ISA Work?

Once you contribute to your Stocks and Shares ISA, your money can be invested in a wide variety of assets. Some investors prefer to build their own portfolio by selecting individual stocks or bonds. Others choose collective investment vehicles such as mutual funds or ETFs, which offer built-in diversification.

When you invest in a fund, for example, your money is pooled with that of other investors to purchase a basket of assets managed by a professional. This reduces the risk compared to putting all your money into one company or sector. Many ISA platforms offer model portfolios based on your risk tolerance and investment goals. These portfolios automatically adjust your asset allocation over time, making them ideal for hands-off investors.

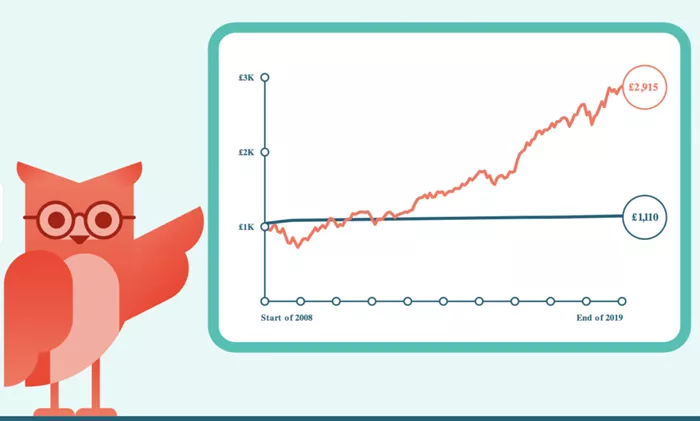

Investments can go up or down in value, so your ISA balance is not guaranteed. However, historical data shows that over the long term, equities tend to outperform other asset classes like cash or bonds. This makes Stocks and Shares ISAs particularly suited for long-term goals such as retirement planning or building a nest egg.

Fees and Costs to Consider

While the tax benefits of a Stocks and Shares ISA are compelling, investors should pay close attention to the fees involved. Most providers charge a platform fee, which is a percentage of your total assets held in the ISA. This might range from 0.25% to 1% annually. Some also charge trading fees each time you buy or sell an investment, or management fees for specific funds.

Robo-advisers tend to offer all-in-one pricing, combining platform and fund fees into a single transparent charge. While they might seem more expensive initially, their automated approach can deliver value through asset allocation and risk management. It’s important to compare not only fees but also the quality of tools, customer service, and educational resources each platform provides.

High fees can eat into your returns over time, so it pays to understand how much you are being charged and what services you are getting in return. Choosing low-cost index funds within your ISA can help minimize expenses while still allowing you to benefit from market growth.

Withdrawing Funds from a Stocks and Shares ISA

One of the often-overlooked advantages of a Stocks and Shares ISA is that it offers more flexibility in withdrawals compared to pensions. You can take money out at any time without penalties or tax consequences. However, it’s crucial to remember that investments should ideally be held for the long term. Selling investments during a market dip can lock in losses and reduce future growth potential.

Some providers offer “flexible” ISAs. This means that if you withdraw money, you can put it back in the same tax year without affecting your annual contribution limit. For instance, if you deposit £10,000, withdraw £2,000, and then reinvest that £2,000 later in the same year, your total contributions still count as £10,000, not £12,000. This flexibility can be useful for managing short-term financial needs without giving up your tax shelter.

However, not all Stocks and Shares ISAs are flexible, so it’s essential to check this with your provider before making withdrawals. Also, bear in mind that if you sell an investment to withdraw cash, it may take a few days for the sale to settle and for the money to become available.

Risks and Considerations

As with any investment product, a Stocks and Shares ISA carries risks. The value of your investments can fall as well as rise, and there is no guarantee that you will get back the amount you originally invested. This risk is especially relevant in the short term, as markets can be volatile.

Market timing is notoriously difficult, so trying to buy low and sell high often leads to poor results. Instead, a common strategy is pound-cost averaging—investing a fixed amount regularly regardless of market conditions. This approach reduces the impact of short-term market swings and encourages disciplined investing.

Another consideration is your investment horizon. Stocks and Shares ISAs are best suited for long-term goals, ideally five years or more. If you need the money sooner, a Cash ISA or another savings vehicle might be more appropriate. Likewise, individuals nearing retirement may want to gradually reduce their exposure to equities and shift toward more stable investments.

Using ISAs for Retirement Planning

While pensions remain the primary vehicle for retirement savings, Stocks and Shares ISAs can play an important complementary role. Unlike pensions, which have strict rules on access and tax treatment upon withdrawal, ISAs are more flexible and can be used for various financial goals.

One popular strategy is to build an ISA portfolio during your working years and then use it as a tax-free income stream in retirement. Since withdrawals are not taxed, ISA funds can be used to top up pension income without increasing your tax liability. This flexibility makes them valuable tools for retirement income planning and estate management.

Furthermore, ISAs can be passed on to a spouse or civil partner upon death without losing the tax benefits. This ensures that wealth accumulated over time can continue to grow and support your family’s financial future.

Conclusion

A Stocks and Shares ISA is more than just an investment account—it’s a versatile, tax-efficient tool for building long-term wealth. By allowing individuals to invest in a wide array of assets without the burden of capital gains or income tax, it offers a compelling opportunity for both novice and experienced investors alike.

The key to making the most of a Stocks and Shares ISA lies in understanding how it works, choosing the right provider, and selecting investments that match your goals and risk tolerance. While the stock market carries inherent risks, the long-term rewards of tax-free growth can be substantial.

Whether you’re saving for a house, planning for retirement, or simply building financial security, a Stocks and Shares ISA can help you get there faster. With careful planning and a steady approach, it can become one of the cornerstones of your financial future.

Related Topics:

What Is the Function of Buying Stocks?

What is the Broadest Indicator of US Stock Market Performance?