Cryptocurrency has evolved from a niche digital asset to a global phenomenon. With its rise, questions surrounding its legality and regulation have become pressing. As governments around the world grapple with how to approach digital currencies, the legality of cryptocurrency varies significantly depending on the country. While some nations fully embrace it, others impose strict regulations or ban it altogether. In this article, we will explore the current legal status of cryptocurrency in various countries, focusing on the factors that influence its adoption and regulation.

The Global Cryptocurrency Landscape

Cryptocurrency operates in a decentralized environment, making it inherently challenging for governments to regulate. Its nature – with transactions occurring across borders and outside traditional financial institutions – raises questions about how countries should manage digital currencies. For some nations, the allure of cryptocurrencies lies in the potential to boost innovation and create new financial ecosystems. Others, however, are concerned about the risk of money laundering, fraud, or the disruption of traditional financial systems.

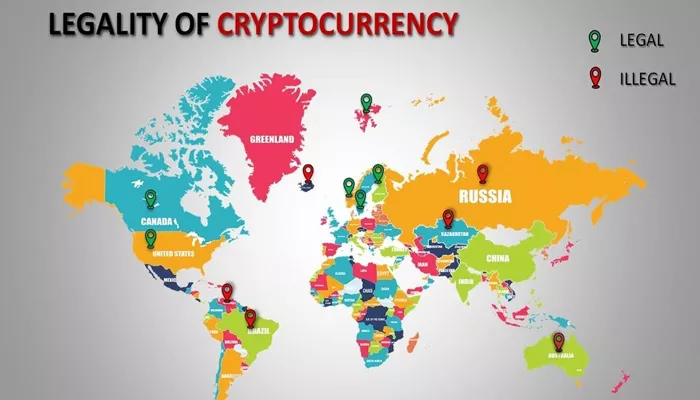

The result is a diverse global landscape. Some countries have embraced cryptocurrencies, creating clear frameworks for their use, while others have placed outright bans on their adoption. Still, many others are taking a cautious approach, attempting to balance innovation with regulation. Let’s delve deeper into the legal status of cryptocurrency in various regions.

Countries Where Cryptocurrency is Legal and Regulated

United States: A Mixed Regulatory Approach

In the United States, cryptocurrency’s legality is not uniform across the nation. While there is no single federal law that governs the use of digital currencies, the U.S. government has taken steps to regulate them through various agencies. The Internal Revenue Service (IRS) treats cryptocurrency as property for tax purposes, meaning that individuals are required to report any gains or losses from their cryptocurrency investments.

Additionally, the U.S. Securities and Exchange Commission (SEC) has taken an active role in regulating certain types of cryptocurrencies, especially those deemed to be securities. For instance, Initial Coin Offerings (ICOs) that offer tokens similar to traditional securities must adhere to securities laws. On the other hand, Bitcoin and Ethereum are generally considered commodities, meaning they are not subject to the same regulation as stocks or bonds.

States have also had their say on cryptocurrency, with some, like Wyoming, embracing it with favorable regulations for crypto businesses, while others, like New York, have introduced more stringent requirements. The state of New York, for example, mandates that businesses dealing with cryptocurrencies obtain a “BitLicense” to operate legally.

Canada: Welcoming Cryptocurrency with Open Arms

Canada is one of the countries where cryptocurrency is legal and well-regulated. The Canadian government does not consider cryptocurrencies like Bitcoin and Ethereum to be legal tender, but they are treated as commodities for tax purposes. As a result, Canadians must report cryptocurrency gains and losses in their annual tax filings.

The regulatory environment in Canada is relatively friendly compared to many other countries. Cryptocurrency exchanges must be registered as money services businesses (MSBs), and they are subject to anti-money laundering (AML) and know-your-customer (KYC) regulations. Furthermore, the country has actively fostered innovation in the blockchain space, and many Canadian businesses have adopted cryptocurrencies for various purposes, including as a method of payment.

Despite the welcoming stance, Canada has also taken steps to address potential risks associated with cryptocurrencies. For example, in 2019, the Canadian Securities Administrators (CSA) issued guidelines stating that cryptocurrencies that qualify as securities must comply with securities laws.

European Union: Diverse Regulations Across Member States

The European Union (EU) does not have a unified stance on cryptocurrency, but the general trend is one of acceptance, with varying degrees of regulation. The EU has taken steps to create a regulatory framework for cryptocurrencies, with proposals like the Markets in Crypto-assets (MiCA) regulation, which aims to provide clarity and oversight for crypto businesses operating across member states.

In some EU countries, cryptocurrencies are widely accepted and even encouraged. For instance, Estonia is one of the leaders in adopting blockchain and cryptocurrency technologies. The country has created a regulatory framework that makes it easy for crypto businesses to operate, and many international crypto companies have set up shop there. Similarly, Malta has earned the nickname “Blockchain Island” for its crypto-friendly laws and regulations.

On the other hand, countries like Germany and France have taken a more cautious approach. Germany treats cryptocurrencies as units of account and allows their use as a means of payment. However, it imposes strict regulations to ensure that cryptocurrencies are not used for illegal activities. France has introduced rules requiring cryptocurrency exchanges to register with the government and adhere to anti-money laundering regulations.

Japan: Leading the Way in Cryptocurrency Regulation

Japan has long been one of the most crypto-friendly countries in the world. In 2017, Japan officially recognized Bitcoin as legal tender, making it the first country to do so. The Japanese government has implemented a comprehensive regulatory framework for cryptocurrency businesses, including requirements for exchanges to register with the Financial Services Agency (FSA) and comply with AML and KYC regulations.

Japan has also established a system to protect consumers, particularly in the wake of high-profile hacking incidents involving cryptocurrency exchanges. After the Coincheck hack in 2018, which saw the loss of over $500 million worth of cryptocurrency, Japan’s regulators took further steps to enhance security measures and protect investors.

Despite its progressive stance, Japan is also cautious about the risks associated with cryptocurrencies. The country imposes strict anti-money laundering laws and has taken measures to prevent the use of cryptocurrencies for illicit purposes. Nevertheless, Japan remains a global leader in cryptocurrency regulation, with a strong emphasis on both innovation and consumer protection.

Countries Where Cryptocurrency is Banned

China: A Hardline Stance Against Cryptocurrency

China has long taken a hardline approach to cryptocurrency, culminating in a comprehensive ban on cryptocurrency trading and mining in 2021. The Chinese government has expressed concerns over the potential for cryptocurrencies to facilitate illegal activities, such as money laundering and fraud. Additionally, the energy consumption associated with cryptocurrency mining has been a significant concern for China, which has prioritized reducing its carbon footprint.

The government has also cracked down on crypto-related businesses, forcing many exchanges to close their operations in the country. While the Chinese government has banned cryptocurrency trading, it has not banned the ownership of digital assets. However, the lack of regulation and the uncertainty around the future of crypto in China has made it difficult for the market to flourish.

Despite this, China remains a key player in the global cryptocurrency market, with a significant portion of global cryptocurrency mining still occurring within the country, even after the ban. The government’s stance has had far-reaching implications for the global crypto market, contributing to fluctuations in prices and market behavior.

India: Uncertainty and Legal Ambiguity

India’s stance on cryptocurrency has been marked by uncertainty. While the Reserve Bank of India (RBI) imposed a banking ban on cryptocurrency exchanges in 2018, the Supreme Court lifted this ban in 2020, ruling that it was unconstitutional. However, despite the court ruling, there has been no clear regulatory framework for cryptocurrency in India, leaving the market in a state of limbo.

In 2021, reports surfaced that the Indian government was considering introducing a bill that could potentially ban cryptocurrencies altogether. While this bill has not yet been passed, it has created significant uncertainty in the Indian crypto market. Many Indian crypto enthusiasts are hoping for a more positive regulatory environment, but the future remains unclear.

India’s uncertainty surrounding cryptocurrency is a major issue for investors and businesses alike. The lack of clarity in terms of regulation and taxation has made it difficult for crypto companies to operate in the country, and many investors are hesitant to fully embrace digital currencies.

Russia: Struggling with Regulation

Russia’s approach to cryptocurrency has been inconsistent. While cryptocurrency is not outright banned in Russia, the legal status of digital assets remains unclear. The Russian government has imposed restrictions on the use of cryptocurrencies for payments, and in 2020, it passed a law that effectively banned the use of digital currencies as a form of payment for goods and services.

However, Russia has not banned the ownership of cryptocurrencies, and many Russians continue to invest in and trade digital assets. The government has shown some interest in creating a regulatory framework for cryptocurrencies, but progress has been slow, and the legal landscape remains murky.

Despite the lack of a clear legal framework, Russia has embraced blockchain technology and has shown interest in developing its own digital currency, the “digital ruble.” The government’s approach to cryptocurrency is still evolving, and its future remains uncertain.

A Divided World of Cryptocurrency Regulation

The legality of cryptocurrency varies greatly from country to country, with some nations embracing it and others rejecting it. In countries like the United States, Canada, and Japan, cryptocurrency is legal and regulated, with frameworks in place to ensure security and compliance. On the other hand, countries like China, India, and Russia have taken a more cautious or even hostile stance, with regulatory uncertainty creating challenges for crypto enthusiasts and businesses.

As cryptocurrency continues to evolve, it is likely that more countries will adopt regulations to govern its use. The global landscape of cryptocurrency regulation is constantly shifting, and what is true today may not be true tomorrow. For individuals and businesses looking to enter the crypto space, staying informed about the legal status of digital currencies in their country is essential for ensuring compliance and avoiding legal issues.

The future of cryptocurrency remains uncertain, but it is clear that its impact on the global financial system will continue to grow. As governments around the world develop their policies, the world of cryptocurrency will become more structured, though its decentralized nature may always present challenges for regulators.

Related Topics:

In What Form Can Cryptocurrencies Be Stored?

What is a Cryptocurrency Exchange?

Which Return Distribution Do Cryptocurrency Investors Prefer?